From 1 July 2021, the value-added tax (VAT) exemption on the importation of goods into the European Union's twenty Seven countries will change. Where previously goods valued at 22 euros and less could be imported tax-free under the tax exemption rule, now all goods imported will be subject to EU VAT tax, regardless of value.

The EU's VAT rule is a general tax that applies to goods and services that are bought and sold for use or consumption in the European Union. These products are taxed upon import, mainly so the market is fair for EU producers and so they can compete on equal terms with other international suppliers.

EU VAT law only requires a standard rate of 15% is applied by each country, for supplies of goods and services so rates vary among EU member states and different products. To get the latest information on a country's VAT rate for a particular product, it is best to check with the state's VAT authority.

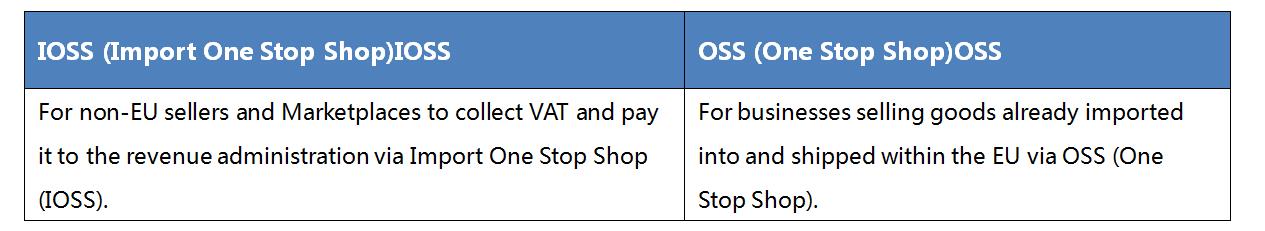

This system is designed to make not only the purchasing process more simplified and transparent but make the shipping and customs process faster. This is because rather than the buyer paying for the VAT separately (when the goods have been imported, as was previously the case), suppliers under IOSS will be responsible for collecting, declaring and prepaying EU VAT to the relevant authorities.

The good news for e-tailers who sell to EU customers through an online marketplace (like eBay or Amazon) is that they may no longer be responsible for collecting and paying VAT, with the new IOSS scheme. With IOSS, it will be the responsibility of the marketplace to collect and pay VAT as part of the shipping process.

Essentially, if your business imports business to consumer products into the EU from outside the EU, which are valued at 150 euros or less, it will be beneficial for yourself and your customers to use IOSS.

BACL Service:

BACL can provide you efficient and reliable global market certification services, such as IECEE CB Scheme NCB and CBTL, United States(NRTL, FCC, ENERGY STAR), Canada(ISED, SCC), EU(CE), United Kingdom (UKCA AB & AOC), Northern Ireland(UKNI), Korea(KC), Japan(MIC), Singapore(IMDA), Hong Kong(OFCA), Taiwan (NCC, BSMI), Egypt (NTRA, GOEIC), South Africa(SABS), Vietnam (MIC), Saudi Arabia (SASO, CITC), Philippines (NTC), Thailand (NBTC), Malaysia (SIRIM), India(BIS, WPC, TEC)and other services to assure your products still smoothly entering into the international trade market even when the international trade barriers are becoming increasingly fierce.

CN/中国

CN/中国  US/USA

US/USA  KR/Korea

KR/Korea  DE/Germany

DE/Germany  ES/Spain

ES/Spain VN/Việtnam

VN/Việtnam