On Nov 24, 2016, Sweden passed a new regulation to levy taxes on electrical and electronic products containing specific toxic substances. Applicable on 1 Apr. 2017, the regulation specifies that Sweden will begin to levy taxes accessing Sweden market since 1 July 2017 and fewer taxes will be required on compliant products.

Electrical and electronic products cover white electrical appliances and other products including ovens, freezers, washing machines, vacuum cleaners, telephones, routers, recreational machines and computers. The targeted chemicals are flame retardants including brominated compounds, chloride compounds and phosphorus compounds (140 kinds).

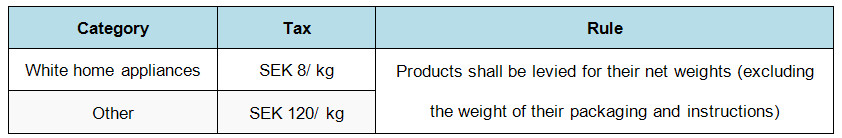

Taxes to be Levied on Electrical and Electronic Products

However tax reduction is granted for compliant products:

50 % off when the concentration of brominated or chloride additives present in homogenous materials of plastic components over 25g or PCB panels exceed 0.1%;

90% off when the concentration of brominated or chloride additives present in homogenous materials of plastic components over 25g or PCB panels exceed 0.1%, and the concentration of phosphorus compounds, brominated or chloride activating agents no more than 0.1%.

BACL Service:

BACL, headquartered in the United Sates, is a global comprehensive international third-party testing and certification service organization. With knowledge of the laws and regulations of various market, BACL can not only offer testing and certification services for finished products including textile and garment, electrical and electronic product, food contact material, shoes and toys, but also help companies to execute quality control over the whole industry chain from raw material to finished products.

CN/中国

CN/中国  US/USA

US/USA  KR/Korea

KR/Korea  DE/Germany

DE/Germany  ES/Spain

ES/Spain VN/Việtnam

VN/Việtnam